“Lakeville MN home loan game theory” sounded like an intriguing topic when the phrase first occurred to me. I thought it would mean figuring out whether a mortgage would constitute a financial move that made sense. But the more I studied “game theory,” the more complicated it got. And maybe not as theoretical as I’d thought...

As far as the terms themselves are concerned, a Lakeville MN “Home Loan” is exactly what it says it is: a mortgage on your Lakeville MN home. “Game theory” is more obscure. For openers, “game theory” sounds like a lot more fun that it really is. It’s like the bore who wants to tell you exactly why some joke is funny—the explanation isn’t at all humorous. ‘Game theory’ isn’t about playing anything. It’s about mathematics.

Professor R.B. Myerson is the authority who tells us that game theory is the study of decision-making. It’s a dissection of “mathematical models of conflict and cooperation.” That’s a pretty good thumbnail description of the board games kids play. If you remember playing Monopoly as a child, you may also remember how mad you’d get if the other players cooperated too much. Sometimes they’d trade properties with each other so that one was able to build hotels on the dark blue properties. That meant that when you landed on Boardwalk, you went broke. Professor Myerson was right: that was a study in cooperation that would make anyone feel conflict.

But the Professor’s definition also says that game theory deals with the actions of “intelligent rational decision-makers.” In home loan game theory, when the process of filling out forms and gathering backup materials goes on and on, it can seem to stretch beyond anything that’s rational. But once you do get a Lakeville MN home loan, the decision-making does seem both intelligent and rational.

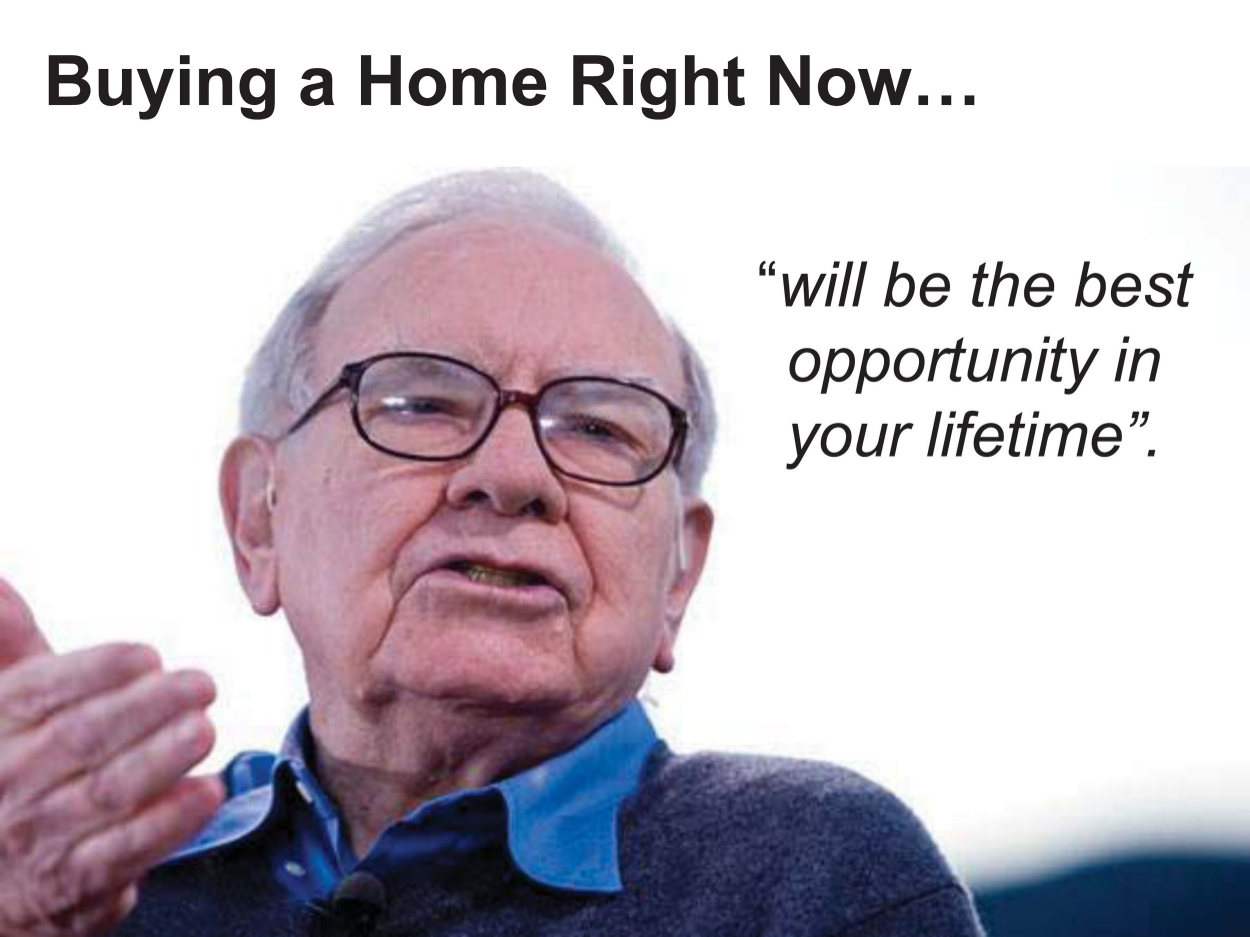

“Lakeville MN home loan game theory,” then, would be the study of strategic decision-making by the person who wants to obtain a home loan and the bank personnel who give the okay. Originally, game theory only dealt with zero-sum games—the ones where if someone gains something, the other one loses. It has since expanded to include all sorts of “win-win” scenarios, but at least one world-renowned investor has a different game theory about home loans. Warren Buffett is quoted as saying:

“You can take a 30-year mortgage and if it turns out your interest rate’s too high, next week you refinance lower. And if it turns out it’s too low, the other guy’s stuck with it for 30 years.”

Come to think of it, that’s exactly what has been happening ever since mortgage rates started coming down! Which is why I’m pretty sure that particular home loan game theory isn’t so theoretical at all.

Important Notice

Copyright 2015 Murphy Inc. All Rights Reserved. This is not intended as legal, technical, or tax advice. Please speak with a licensed professional before making any decision. Information is deemed reliable but not guaranteed as of the date of writing. The views expressed here are Tim Murphy’s personal views and do not reflect the views of Metropolitan Home Team.